cheap auto insurance cheaper cars low-cost auto insurance cheaper car

cheap auto insurance cheaper cars low-cost auto insurance cheaper car

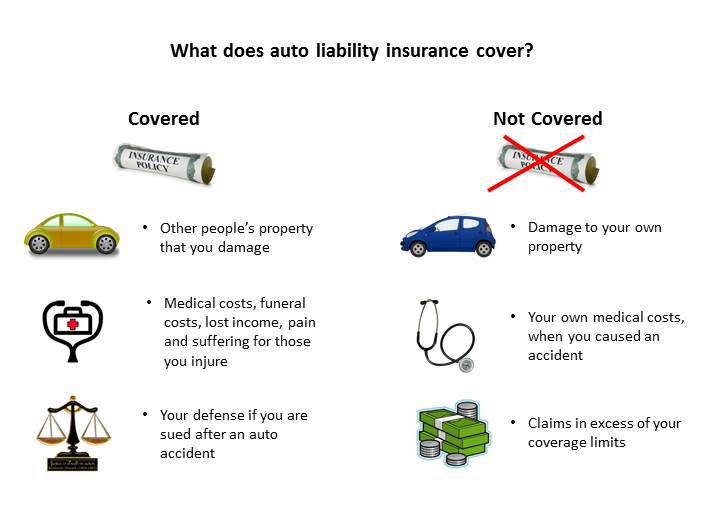

What Is Responsibility Automobile Insurance Coverage? Responsibility car insurance policy is the component of a car insurance coverage that gives economic protection for a chauffeur that damages somebody else or their residential property while operating a lorry. Automobile obligation insurance coverage only covers injuries or damages to 3rd parties and their propertynot to the vehicle driver or the motorist's home, which may be independently covered by various other parts of their plan (cheaper cars).

In numerous states, if a motorist is located to be responsible in the crash, their insurer will certainly pay the property and medical expenditures of other parties involved in the accident up to the limitations established by the policy (suvs). In states with no-fault auto insurance policy, however, chauffeurs associated with an accident has to first sue with their own insurer no matter that was at fault.

insurance insure risks suvs

insurance insure risks suvs

Any kind of expenses that exceed the restriction end up being the duty of the at-fault motorist. Responsibility Restriction for Bodily Injury per Individual The per-person restriction is the optimum amount that the insurance provider will pay for each person that has been injured in an accident. Liability Limit for Physical Injury per Crash The responsibility limitation per accident is a monetary cap for the complete quantity that the insurance company will pay for every one of the individuals included in a mishap.

The at-fault driver would certainly after that be accountable for any medical costs above that limitation. Note Physical injury liability insurance coverage can safeguard your house as well as other properties in the occasion that you're sued by a motorist or guest complying with an accident - insurers. Requirements for Responsibility Automobile Insurance Each state establishes a minimum for just how much responsibility insurance coverage a driver need to carry (insure).

Instance of Responsibility Auto Insurance Policy Below is an example of how obligation auto insurance policy may function in a state without no-fault insurance. cheap. Let's state the vehicle driver had the adhering to obligation automobile coverage with their insurance coverage business: Bodily injury liability limitation per individual of $60,000 Physical injury restriction per accident of $150,000 The insured enters into an accident entailing multiple people and is ruled at-fault for any damages.

What Does What Does Liability Insurance Cover? (2022 Guide And Cost) Do?

Additionally, the total expenses for every person involved (except the at-fault chauffeur) was $120,000, which is much less than the per-accident bodily injury restriction. It's essential to keep in mind that some policies will not cover any type of costs beyond the per-accident limit even if the per-person limitations have not been exceeded. Using the example over, allow's state each individual had clinical costs of $55,000.

Consequently, the at-fault motorist would certainly be accountable for the additional $15,000. Essential While states set required minimums for vehicle insurance responsibility protection, acquiring more than the minimum is typically a clever action. Liability vs. auto. Full-Coverage Auto Insurance coverage Along with the responsibility insurance coverage your state calls for, insurers use insurance coverage understood as collision as well as extensive insurance policy.

Comprehensive generally covers damage from fire, criminal damage, or falling things, such as a large tree limb or hail storm. These two kinds of insurance are optional for cars that are had cost-free as well as clear.

Because most of these provisions can vary from state to state, it deserves consulting an experienced insurance coverage agent or broker that is acquainted with your state's regulations (insurance company). It's additionally valuable to compare cars and truck insurance prices to guarantee that you're getting the very best deal on protection (vehicle insurance).

prices money liability liability

prices money liability liability

Plan specifics vary from service provider to provider, liability insurance commonly consists of the adhering to 2 kinds of coverage: Bodily Injury (BI) Liability: If you're at fault in a crash, this will cover the medical costs for those harmed throughout the accident. It will certainly additionally cover loss of earnings that resulted from injuries received, as well as costs associated with pain and suffering.

The smart Trick of Pay-per-mile Liability Car Insurance - Metromile That Nobody is Discussing

That can include damages to other automobiles and other sorts of building, like residences, fence, as well as stores. business insurance. Recognizing Responsibility Limits, All responsibility vehicle insurance plan have limitations, or just how much an insurance firm will certainly pay out on an insurance claim. Obligation insurance coverage limitations are divided right into 3 classifications: Physical injury per individual Physical injury per crash Building damage per crash.

It can also cover you if you get struck by an automobile while riding your bike. That Needs Liability Insurance Coverage? If you're driving in the United States, you'll likely need some kind of standard responsibility insurance coverage. low cost. Today, most states as well as the District of Columbia have legislations that call for vehicle drivers to bring responsibility insurance policy, though the type as well as quantity can differ.

Car liability insurance protection assists cover the expenses of the various other vehicle driver's home as well as physical injuries if you're found liable in an accident. The auto obligation coverage interpretation may seem easy sufficient, yet here's a real life example: you go to a four-way quit a few blocks from your residence - perks.

The next point you understand; you've wrecked into an additional motorist's vehicle in the middle of the junction - credit. Your insurance provider will certainly collaborate with the various other chauffeur's insurance provider to identify that is at fault (if you live in a no-fault state). If you have obligation insurance, your insurance coverage provider will certainly cover expenses for the chauffeur's broken cars and truck, minus your insurance deductible, as well as as much as your covered limitation.

In some conditions, it may even cover shed salaries and/or lawful fees if the victim files a legal action. Home damage responsibility defense uses to damages to property resulting from a covered crash in which you're at fault. It may cover the other celebration's car fixing or replacement expenses, in addition to other residential property that might have been damaged in the accident, such as fencings, structures, phone poles and other sorts of home.

Fascination About Liability-only Vs. Full Coverage Car Insurance: How To Choose

You can decide for a larger quantity than the minimum needed by your state, depending on your demands. insurance company. Assume of liability insurance policy as the baseline for auto insurance coverage.

State law claims that a legislation enforcement officer can not quit you solely to examine if you have an insurance coverage card, yet she or he can ask you for evidence of insurance policy throughout a stop for any kind of various other statutory offense. The initial fine for Go to this site falling short to maintain an insurance coverage card is $1,000 as well as suspension of driving opportunities for one year or till the automobile owner reveals evidence of insurance - cheapest car.

If your automobile was funded, most commonly your lending institution will certainly require you to bring crash and extensive coverage - business insurance. If you have an older car, you could decide to forego the collision and extensive insurance coverages altogether.

You may intend to make a worksheet to aid you keep track of the automobile insurance coverage estimates you obtain from different business. Several firms offer discounts for bundling auto as well as house plans. It is a good concept to keep track of the price cuts used by each business. If you possess 2 or even more cars as well as have all your automobile insurance coverage with one business, you are usually qualified for a discount under a "multi-car" plan.

Pay your insurance coverage in a prompt manner. If you are terminated for non-payment of premium, it will be tougher to locate a firm willing to cover you.

The Liability Car Insurance Coverage: Guide For 2022 - Wallethub Diaries

While it is crucial to maintain the price of vehicle insurance reduced, rate ought to not be the only factor to consider when you are purchasing insurance coverage. As the claiming goes, you get what you spend for. Along with comparing costs, it is a good concept to contrast the monetary strength of a business, its online reputation for solution, certain protections, price cuts and also other advantages they use.

If you have problem getting the information from the business itself, you might wish to believe two times about getting from them. If you are involved in a crash and have an insurance claim, there are certain points that you should do: Call the police even if it is a crash where the cops do not normally react.

Inform your insurance agent or business as quickly as feasible. Obtain the names and also addresses of all witnesses and people entailed in the crash.

vehicle money prices accident

vehicle money prices accident

If you have a loss, notify your firm without delay. Make duplicates of the completed kinds to maintain on your own. After the firm is notified of your claim, they ought to send you any kind of necessary types to validate your insurance claim. The claim ought to be paid promptly after the firm has actually gotten sufficient evidence of loss.